KAS Bank N.V.-German Branch für die Anleihe der Exporo Hannover GmbH-keine neuen Bilanzen-letzte hinterlegte Bilanz aus dem Jahre 2009

Natürlich schaut man sich dann auch einmal die wichtigen Partner der EXPORO Hannover GmbH einmal etwas genauer an. Hier zum Beispiel die Zahlstelle. Hierzu heißt es im Prospekt: Zitat:1. Zahlstelle

- Zahlstelle ist die KAS BANK N.V. – German Branch mit dem Sitz in Frankfurt am Main (die

„Zahlstelle“). Die Zahlstelle ist berechtigt, sich der Dienste Dritter zu bedienen und/oder Aufgaben an Dritte zu übertragen. Die Zahlstelle in ihrer Eigenschaft als solche handelt ausschließlich als Beauftragte der Emittentin und steht nicht in einem Auftrags- oder Treuhandverhältnis zu den Anleihegläubigern. Die Zahlstelle ist von den Beschränkungen des § 181 BGB befreit.

- Die Emittentin wird dafür Sorge tragen, dass stets eine Zahlstelle vorhanden ist. Die Emittentin ist berechtigt, andere Banken als Zahlstelle zu bestellen. Die Emittentin ist weiterhin berechtigt, die Bestellung einer Bank als Zahlstelle zu widerrufen. Im Falle einer solchen Abberufung oder falls die bestellte Bank nicht mehr als Zahlstelle tätig werden kann oder will, bestellt die Emittentin eine andere Bank als Zahlstelle. Die Bestellung einer anderen Zahlstelle ist von der Emittentin unverzüglich gemäß Ziff. 11 bekannt zu

Zitat Ende

Geht man dann einmal, wie wir, ins Unternehmensregister, dann findet man dann auf en ersten Blick keine neue (aktuelle) hinterlegte udn öffentlich zugängliche Bilanz. Erst wenn man dann ein Häkchen in „auch gelöschte Firmen macht“ wird das Suchergebnis dann etwas größer. Hier findet man dann als letzte hinterlegte Bilanz eine Bilanz aus dem Jahre 2009, aber auch wenn man in den „Bezahlbereich geht“ findet man auch dort keine Bilanzen. Diese nachfolgende Bilanz dann zu BEWERTEN macht wenig Sinn, denn dafür ist die Bilanz einfach zu alt.

KAS BANK N.V. – German Branch

Wiesbaden

Jahresabschluss zum 31. Dezember 2009

Five years in figures KAS BANK N.V.

| Consolidated, in millions of euros | 2009 | 2008 | 2007 | 2006 | 2005 |

| Equity attributable to equity holders of the bank | 193.4 | 167.5 | 254.9 | 217.6 | 207.8 |

| Own funds | |||||

| (Equity attributable to equity holders of the bank plus subordinated liabilities) | 193.4 | 167.5 | 266.3 | 247.1 | 237.3 |

| Total assets | 6,329.7 | 7,360.2 | 8,371.8 | 6,448.5 | 7,774.0 |

| Income | |||||

| Net interest | 30.6 | 28.9 | 21.6 | 16.8 | 23.3 |

| Net commission | 75.3 | 89.2 | 93.4 | 83.3 | 77.7 |

| Result on investments | 28.9 | 10.9 | 32.9 | 28.5 | 19.1 |

| Other income | 2.0 | 0.6 | 26.2 | 1.7 | 0.4 |

| Total income | 136.8 | 129.6 | 174.1 | 130.3 | 120.5 |

| Operating expenses | 105.3 | 108.2 | 102.1 | 94.2 | 93.3 |

| Impairment losses | -0.3 | 73.4 | 4.7 | – | – |

| Total operating expenses | 105.0 | 181.6 | 106.8 | 94.2 | 93.3 |

| Result for the period before tax | 31.8 | -52.0 | 67.3 | 36.1 | 27.2 |

| Result for the period attributable to equity holders of the bank | 24.6 | -39.9 | 50.9 | 26.6 | 19.4 |

| Figures per share of C1.00 nominal value (in eu ros) | |||||

| Net asset value after proposed dividend | 13.27 | 11.49 | 14.19 | 13.65 | 13.55 |

| Basic earnings per share | 1.69 | -2.70 | 3.41 | 1.79 | 1.32 |

| Dividend | 0.73 | 0.45 | 2.60 | 1.40 | 1.00 |

| Share price, high | 14.40 | 29.30 | 29.69 | 23.15 | 19.10 |

| Share price, low | 6.95 | 9.45 | 20.49 | 18.66 | 15.11 |

| Share price, year-end | 14.05 | 9.90 | 25.00 | 20.85 | 18.70 |

| Ratios (%) | |||||

| Net return on average shareholders‘ equity | 13.7 | -20.2 | 23.7 | 13.2 | 9.7 |

| Efficiency ratio (operating expenses/income) | 79 | 81 | 76 | 77 | 77 |

| Growth in basic earnings per share (%) | 162 | -179 | 91 | 36 | 21 |

| BIS ratio (average) * | 21 | 15 | 16 | 17 | 17 |

* The BIS ratios for the years 2005-2007 are based on Basel I. The BIS ratios for 2008 and 2009 are based on Basel II.

ANNUAL REPORT 2009

The annual report and accounts have been prepared in the Dutch language. This document is a translation.

Where differences arise between the English and Dutch texts, the latter takes precedence.

Profile of KAS BANK N.V.

KAS BANK N.V. is a European specialist in securities services, connecting professional financial institutions across the globe. From its primary services of investment administration, custody, clearing and settlement, value-added services have evolved in the field of treasury, risk control and management information.

KAS BANK pursues a ‚pure play‘ strategy: it does not provide active asset management services itself and is independent. Its neutrality precludes conflicts of interest with its clients and guarantees its impartiality and autonomy. A low risk profile is integral to its services.

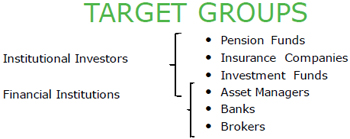

As an independent specialist, we view the market from the perspective of our clients: institutional investors (pension funds, insurance companies, investment funds and asset managers) and financial institutions (banks and brokers). Our clients are based all over Europe; the Netherlands, Germany and the United Kingdom are our core markets.

Mutual trust and absolute transparency are fundamental to our services and to our relationship with our clients. Outsourcing their administrative functions to KAS BANK enables our clients to focus primarily on their own core services. Client focus and operational excellence are crucial: the client and the faultless processing on which the client depends are paramount. This is achieved by combining a proactive approach with advanced information technology and optimum process control. KAS BANK uses a single central technology platform for all European markets with which it has direct connections.

KAS BANK has offices in Amsterdam, London and Wiesbaden and employs around 800 staff. Founded in 1806, it has been listed on the NYSE Euronext Amsterdam stock exchange since 1986.

Contents

Personal notes

Information for shareholders

Report of the Supervisory Board

Report of the Managing Board

Financial statements

| • |

Consolidated income statement |

| • |

Consolidated statement of comprehensive income |

| • |

Consolidated balance sheet |

| • |

Consolidated statement of changes in equity |

| • |

Consolidated statement of cash flows |

| • |

Accounting policies |

| • |

Notes to the consolidated income statement |

| • |

Notes to the consolidated balance sheet |

| • |

Notes on off-balance-sheet commitments and contingent liabilities |

| • |

Risk management |

| • |

Segment information |

| • |

Share-based payments and related parties |

| • |

Auditors‘ fees |

| • |

Company income statement |

| • |

Company balance sheet |

| • |

Notes to the company financial statements |

| • |

Management declaration and signature |

Other information

| • |

Appropriation of result for 2009 |

| • |

Auditors‘ report |

Various reports and statements

| • |

Report of Stichting Administratiekantoor Aandelen KAS BANK (KAS BANK Registrar’s office) |

| • |

Report of Stichting Administratiekantoor Aandelen KAS BANK Effectenbewaarbedrijf (KDTC Registrar’s Office) |

| • |

Report of Stichting Administratiekantoor Aandelen KAS BANK Derivaten Clearing (KASDC Registrar’s Office) |

Corporate governance

Personal notes

Situation as at 3 March 2010

Supervisory Board

D.J.M.G. Baron van Slingelandt (1946), chairman

J.M.G. Frijns (1947), vice-chairman

C. Griffioen (1941)

A.H. Lundqvist (1945)

R.A.H. van der Meer (1949)

H. Donkervoort (1953)

| D.J.M.G. Baron van Slingelandt, chairman | |

| Profession/current principal position | : None |

| Previous principal position | : Member of the Executive Board of Rabobank Nederland and Chairman of the Managing Board of Rabobank International |

| Other positions | : Member of the Supervisory Board of IHC Merwede Holland B.V. and Redevco Europe Services B.V. |

| First appointed | : 2007 |

| Current term of office expires | : 2011 |

| J.M.G. Frijns, vice-chairman Profession/current principal position | : Endowed Professor of Investment Theory at Amsterdam Free University |

| Previous principal position | : Chief Investment Officer and member of the Board of Directors of Pensioenfonds ABP |

| Other positions | : Member of the Supervisory Board of IMC International Marketmakers B.V. and Bouwinvest B.V.; member of the Board of Directors of JP Morgan Funds (Luxembourg) and Rabo Ledencertificaten N.V.; member of the investment committee of PFZW and the Advisory Board of the Norwegian government pension fund; chairman of the Corporate Governance Code Monitoring Committee (until June 2009) |

| First appointed | : 2008 |

| Current term of office expires | : 2012 |

| C. Griffioen | |

| Profession/current principal position | : None |

| Previous principal position | : Member of the Executive Board and CFO of Koninklijke KPN N.V. |

| Other positions | : Vice-chairman of the Supervisory Board and chairman of the Audit Committee of N.V. Nederlandse Gasunie; vice-chairman of the Supervisory Board of Berenschot Holding B.V.; vice-chairman of the Board of Trustees of Zorggroep Noorderbreedte; member of the Supervisory Board and chairman of the Audit Committee of Tennet Holding B.V.; advisory member of the Managing Board of Deloitte. |

| First appointed | : 1998 |

| Current term of office expires | : 2010 |

| A.H. Lundqvist Profession/current principal position | : Chairman of the Executive Board of Eindhoven University of Technology |

| Previous principal position | : CEO of IBM Nederland N.V. |

| Other positions | : Chairman of the Supervisory Board of Generali Verzekeringsgroep N.V., Surfnet B.V. and Surfdiensten B.V.; member of Supervisory Board of TIAS-Nimbas Business School; chairman of the Board of Trustees of St. Anna Zorggroep; member of the Science and Technology Policy Advisory Council. |

| First appointed | : 2001 |

| Current term of office expires | : 2013 |

| R.A.H. van der Meer Profession/current principal position | : Professor of Finance at Groningen University; General Manager of P&C B.V./Lesuut Finance B.V. |

| Previous principal position | : Member of the Executive Board of Fortis. |

| Other positions | : Chairman of the Supervisory Board of BNP Paribas Obam, Stadsherstel Den Haag N.V. and vice-chairman of Corio N.V.; member of the Supervisory Board of European Asset Trust N.V., Robein Leven N.V. and J.P. Morgan (SICAV) and Teslin Capital Management N.V.; member of the DSI Arbitration Commission; deputy member of the Enterprise Section of the Amsterdam Court of Appeal. |

| First appointed | : 2005 |

| Current term of office expires | : 2013 |

| H. Donkervoort Profession/current principal position | : Chairman of the Board of Trustees of ROC Drenthe College |

| Other positions | : General Manager of ID Management & Advies B.V.; member of the Supervisory Board of Stichting Woonborg; member of the Executive Committee of Stichting Technomatch; member of the Programme Committee of Samenwerkingsverband Noord-Nederland; member of the Board of Trustees of Jeugdhulp Friesland. |

| First appointed | : 2006 |

| Current term of office expires | : 2010 |

The members of the Supervisory Board are Dutch nationals.

Managing Board

A.A. Röell (1959), chairman

R.J. Kooijman (1961), Chief Financial Officer

N.E. Blom (1962), Chief Operating Officer

S.A.J. van Katwijk (1964), Chief Commercial Officer (since 1 July 2009)

Managing Director

L.G. Vis

Assistant Managing Director

H. Brink

Chief Risk Officer

K. Wulteputte

Internal auditor

J. Voskuilen

Secretary to the Managing Board

M.G.F.M.V. Janssen

Dear shareholder,

2009 was an unusual year for the financial world in many respects. With central government support, in breadth and often in depth, the markets recovered sufficiently to justify the assertion that a complete system meltdown had been successfully averted. Many banks are now reconsidering their position, often in company with other financial institutions, rating agencies and supervisory and regulatory authorities. But what will the future bring?

The past year revealed that the large and internationally active banks were not always flexible enough to avoid a systemic crisis. Their solvency was eroded by movements in the value of structured financial products and writedowns on business loans, compounded by the devaluation of their real estate portfolios, while the banks‘ action to lower their debt levels shrank their balance sheets. Tighter conditions put the brakes on lending to the private sector in the eurozone, while the region’s banking sector received generous liquidity support from the European system of central banks.

KAS BANK weathered the storm weII. Although the more cautious stance adopted by the financial industry in the face of this uncertainty translated into lower revenues, the bank responded effectively and ended 2009 in profit. The acquisition of Deutsche Postbank’s investment management company in mid-2009 has strengthened our position in Germany and demonstrated that KAS BANK is able to stay firmly on course, even in difficult times – and without recourse to government support or the capital market.

The choice on the market is less a question of big or small and more one of specialised or diversified. Our positioning as a’pure player‘, a wholesale bank with a business model that combines client focus and a high degree of specialisation, continued to prove its worth during the crisis.

A cautious start has been made on rebuilding, in response to the public’s demand for a cultural change within the financial sector. New regulations are being developed, designed to ensure that such a situation never arises again. Meanwhile, the international aspect is becoming increasingly dominant, as is evident for example from the activities of the G20 countries and the reports and directives issued by the European Union.

We are well aware that public confidence in the banks has been shaken by the credit crisis. KAS BANK is working hard to make a substantive contribution to restoring trust in the financial industry. In that context, we endorse the initiatives being undertaken in the field of regulation and supervision and, as from 1 January 2010, we have implemented virtually unchanged the Banking Code that complements the Dutch corporate governance code.

We thank our shareholders, our clients and our staff for their confidence in the bank.

Amsterdam, 3 March 2010

KAS BANK N.V.

A.A. Röell, Chairman of the Managing Board

Information for shareholders

Attendance at the General Meeting of Shareholders

The shareholders and depositary receipt holders attending the General Meeting of Shareholders on 22 April 2009 represented well over 50% of the votin g capital (66%). Stichting Administratiekantoor Aandelen KAS BANK (‚KAS BANK Registrar’s Office‘), acting on behalf of holders of depositary receipts who did not attend the meeting in person, therefore represented less than 50% of the voting shares (34%). All depositary receipt holders attending the meeting were automatically given voting rights by KAS BANK Registrar’s Office. All resolutions at the meeting were adopted by acclamation.

Listing

The ordinary shares, in the form of depositary receipts, have been listed on the Official Market of the NYSE Euronext Amsterdam N.V. stock exchange since 1986. KAS BANK is included in NYSE Euronext’s Amsterdam Smallcap Index (AScX).

Dividend policy

In accordance with the dividend policy discussed with the General Meeting of Shareholders, our target is to distribute 60-80% of the net result, where the profit permits and unless prevented by exceptional ci rcu msta nces.

It is proposed that a dividend be declared for 2009 of €0.73 per ordinary share. An interim dividend of €0.33 per ordinary share already having been distributed, the final dividend, which will be payable in cash, will be €0.40.

5% holdings

The following institutions have given notification of holdings of 5% or more in KAS BANK, pursuant to the Financial Supervision Act and the Decree on Disclosure of Control and Major Holdings in Listed Companies.

| – Aviva plc | 12.7% |

| – APG Algemene Pensioen Groep N.V. | 8.8% |

| – Delta Deelnemingen Fonds N.V. | 8.6% |

| – ING Groep N.V. | 7.9% |

| – All Capital Holding B.V. | 5.3% |

| – KAS BANK N.V. | 5.1% |

Standard & Poor’s ‚A-‚ rating

KAS BANK was given an ‚A-‚ long-term rating and an ‚A-2′ short-term rating by Standard & Poor’s in 2009. The rating outlook was classed as ’stable‘. These ratings were confirmed by Standard & Poor’s in early 2010.

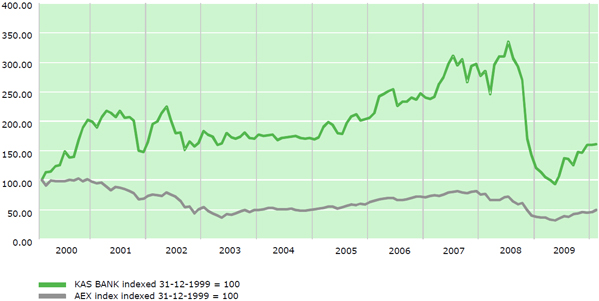

KAS BANK N.V. share price

Movements in the (indexed) price of KAS BANK depositary receipts over the past ten years are compared with the AEX Index in the graph on the next page.

Figures per KAS BANK share

Over the past year, the price of KAS BANK shares rose by around 42% from €9.90 (at year-end 2008) to €14.05 (at year-end 2009). The basic earnings per KAS BANK share in 2009 were €1.69 (2008: €2.70 negative). On average, around 24,000 (2008: 14,000) KAS BANK shares were traded daily on NYSE Euronext Amsterdam in 2009. The figures per KAS BANK ordinary share can be found in the ÔFive years in figures‘ summary.

2010 financial calendar

| 4 March 2010 | – announcement of 2009 figures |

| – analysts‘ meeting | |

| 25 March 2010 | – publication of 2009 annual report |

| 21 April 2010 | – Annual General Meeting of Shareholders |

| – first-quarter 2010 figures | |

| 23 April 2010 | – ex-dividend quotation of KAS BANK N.V. depositary receipts |

| 27 April 2010 | – record date for determination of dividend entitlement |

| 5 May 2010 | – 2009 final dividend payable |

| 26 August 2010 | – publication of 2010 interim figures |

| – analysts‘ meeting | |

| 27 August 2010 | – ex-dividend quotation of KAS BANK N.V. depositary receipts |

| 31 August 2010 | – record date for determination of dividend entitlement |

| 8 September 2010 | – 2010 interim dividend payable |

| 3 November 2010 | – third-quarter 2010 figures |

2011 financial calendar

| 3 March 2011 | – announcement of 2010 figures |

| – analysts‘ meeting | |

| 24 March 2011 | – publication of 2010 annual report |

| 20 April 2011 | – Annual General Meeting of Shareholders |

| – first-quarter 2011 figures | |

| 22 April 2011 | – ex-dividend quotation of KAS BANK N.V. depositary receipts |

| 26 April 2011 | – record date for determination of dividend entitlement |

| 4 May 2011 | – 2010 final dividend payable |

| 25 August 2011 | – publication of 2011 interim figures |

| – analysts‘ meeting | |

| 26 August 2011 | – ex-dividend quotation of KAS BANK N.V. depositary receipts |

| 30 August 2011 | – record date for determination of dividend entitlement |

| 8 September 2011 | – 2011 interim dividend payable |

| 25 October 2011 | – third-quarter 2011 figures |

Report of the Supervisory Board

To the General Meeting of Shareholders

We hereby present the annual report and financial statements for the 2009 financial year, as prepared by the Managing Board. In this report, we inform you of the work of the Supervisory Board in 2009 and how we have supervised the bank’s policy and general course of affairs.

2009 financial statements

The Supervisory Board discussed the 2009 financial statements with the Managing Board and the external auditors. The 2009 financial statements have been examined by the external auditors KPMG Accountants N.V., whose unqualified report thereon can be found on page 116 of this annual report. We recommend that the General Meeting of Shareholders adopt the 2009 financial statements.

It is proposed that, in accordance with the company’s dividend policy, a dividend be declared for 2009 of €0.73 per ordinary share. An interim dividend of €0.33 per ordinary share already having been distributed, the final dividend, which will be payable in cash, will be €0.40.

We also propose that the members of the Managing Board be discharged of liability for their management and the members of the Supervisory Board for their supervision in 2009.

Corporate governance

Partly occasioned by the credit crisis, 2009 brought a large number of codes, recommendations and principles, including the revised Dutch corporate governance code (10 December 2008), the recommendations of the Maas Committee (‚Restoring trust‘), the Banking Code that evolved from them and two reports from the Nederlandsche Bank (DNB) and the Authority for the Financial Markets (AFM) entitled ‚Principles for sound compensation practices‘ and ‚Towards sound compensation practices‘. The Minister of Finance and the financial sector have entered into a ‚gentlemen’s agreement‘ and the administration has presented its vision of the sector’s future. The Supervisory Board discussed the Dutch corporate governance code and the Banking Code with the Managing Board and action has been taken to comply with the two codes.

As from 1 January 2010, the corporate governance code has been officially designated as the code of conduct with which all Dutch listed companies are to be bound. The bank’s status in terms of compliance with the updated code is discussed in the section ‚Corporate governance‘.

The Banking Code also came into effect on 1 January 2010. KAS BANK explains on its website the steps it has already taken to implement the Banking Code. Each year in its annual report, starting with the 2010 financial year, the bank will report on compliance with the principles of the Banking Code. The Minister of Finance has indicated that the statutory basis for the Banking Code will be made effective as from 1 January 2010.

KAS BANK has posted the full text of the corporate governance code and the Banking Code on its website, with explanatory notes appended to each best-practice provision.

Further information on the corporate governance ode and the Banking Code will be presented at the forthcoming General Meeting of Shareholders.

Composition of the Managing Board

Mr. R.J. Kooijman was appointed Chief Financial Officer (CFO) of KAS BANK with effect from 1 January 2009 and was appointed to the Managing Board by the Supervisory Board with effect from 22 April 2009.

Mr. S.A.J. van Katwijk was appointed as a member of the Managing Board and Chief Commercial Officer of KAS BANK with effect from 1 July 2009. Mr. Van Katwijk was appointed to the Managing Board to succeed Mr. Kadiks, who left the bank on 1 September 2009. The Supervisory Board owes Mr. Kadiks a special debt of gratitude for the contribution he made to KAS BANK’s further commercial development.

Meetings of the Supervisory Board

The Supervisory Board met with the Managing Board on nine occasions in 2009. Six of these meetings were scheduled and three were extra meetings. The Supervisory Board also met in the absence of the Managing Board on one occasion. All members of the Supervisory Board attended all the meetings.

One of the most important items on the agenda of all the meetings in 2009 was the risk-management programme initiated by KAS BANK in response to the events of 2008. The implementation of the programme was closely monitored by the Supervisory Board and is still included on the agenda of all its meetings. The FIRM system developed by the Nederlandsche Bank (DNB) is used for risk analysis and management. The FIRM system analyses the bank’s primary and secondary processes with reference to a framework covering the ten most significant risk categories for financial institutions. In the same context, the Supervisory Board also discussed the bank’s ICT structure in depth. The configuration and functioning of KAS BANK’s internal control and monitoring systems remain a priority issue for the Supervisory Board.

KAS BANK’s risk management and risk appetite were discussed at length and the bank’s low risk appetite was endorsed by Supervisory Board. The issue of risk appetite will be the subject of annual review at the Supervisory Board’s meetings.

The consequences of the credit crisis for KAS BANK were also debated extensively. The Supervisory Board discussed the company’s strategic development and plans and the risks associated with the company’s operations in the light of the credit crisis and the changed financial market. The Supervisory Board endorses the bank’s strategy, based on ‚pure play‘, neutrality, transparency and financial stability, and supports the bank’s ambition of European consolidation. The Supervisory Board and Managing Board evaluated several strategic scenarios, some of which were further developed, and the company’s capital structure was subjected to critical review. KAS BANK withstood the financial crisis without recourse to government support or the capital market.

The Supervisory Board discussed the financial results, the performance analyses, the reporting process in relation to targets and the budget and the sensitivity of the results to external circumstances. The financial statements, the annual analysis and the management letter were considered in the presence of the external auditors. The early publication of the full-year figures for 2008 in connection with additional impairment losses on the investment portfolio was discussed within the Board.

Other important items on the agenda included the composition of the Managing Board and the Supervisory Board and the preparation of the new remuneration policy for the Managing Board which is to be submitted to the shareholders for approval in April 2010. Strengthening the structure of the first management echelon was also discussed. The new Chief Commercial Officer presented his commercial plans at several meetings. The agenda also included the acquisition of Deutsche Postbank’s investment management company and the reports of the rating agencies and analysts.

Lastly, a number of presentations were given to the Supervisory Board by senior management, including presentations on social policy and personal development, Global Fund Services and risk management and the bank’s risk appetite.

At the meeting held in the absence of the Managing Board, the Supervisory Board discussed its membership profile, its own functioning and that of the Managing Board and the relationship between the Supervisory Board and the Managing Board. The functioning of the Supervisory Board and its committees was subjected to a critical review in the light of the credit crisis and the pressure on financial institutions, not least in respect of their supervision. The Supervisory Board conducted a self-assessment and concluded that there was scope for strengthening the board in some areas, which will be addressed in the membership profile, but the outcome of the assessment was generally positive. The functioning of the Managing Board was also given a favourable review. Agreement was reached on a point of concern in the relationship between the two boards, namely communication on the human resources aspect of the business.

Members of the Supervisory Board attended two consultation meetings of the Employees‘ Council at which the bank’s general state of affairs, its results and other developments were discussed.

There was regular contact outside the plenary meetings, both between the chairmen of the Supervisory Board and Managing Board and between the other members.

Principles of remuneration policy/remuneration report

The current remuneration policy for the Managing Board, which was adopted and approved by the General Meeting of Shareholders in 2007, is posted on KAS BANK’s website. The remuneration of the individual members of the Managing Board is set by the Supervisory Board on the recommendation of the Appointments and Remuneration Committee, which is assisted by KAS BANK’s Internal Audit department in determining the components of the variable remuneration.

The current fixed salary is based on the salaries paid by a basket of some 30 companies that are comparable with KAS BANK in terms of operating region (Netherlands and Europe) and size. The fixed salary lies between the median and third quartile and is reviewed every two years in the light of developments in the market.

A review in 2009 was deferred in connection with the credit crisis.

There was no review of the fixed salaries of the members of Managing Board in 2009 and they were not reviewed for 2010. The fixed annual salary of the chairman of the Managing Board has remained at €350,000 since 1 January 2008. The fixed annual salary of the other members of the Managing Board is between €225,000 and €250,000.

The annual short-term variable remuneration of the Managing Board is determined with reference to a number of performance criteria set by the Supervisory Board. Of these criteria, 70% are quantitative, in the form of KAS BANK’s external financial targets, and 30% are qualitative, relating to operating performance and strategic policy. The quantitative criteria include the growth in income versus the growth in expenses, the efficiency ratio, the return on equity and the growth in earnings per share. In addition to the performance criteria, an individual criterion is also applied, based on the performance of each individual member of the Managing Board.

The performance criteria are selected such that they do not encourage members of the Managing Board to act in their own interests or take risks that are inconsistent with the approved strategy.

The criteria for ‚at target‘ performance are above the lower limit of the external targets and above the operating results for the previous year. The ‚at target‘ percentages of the fixed income for the short-term variable remuneration are 40% for the chairman and 30% for the other members of the Managing Board.

The bank ended 2009 with an improved result, higher operating profit and a strong balance sheet. Operating expenses were 3% lower, despite the consolidation of an acquisition in Germany and the cost of its integration into the organisation. The bank responded effectively to developments on the European capital markets with its interest and investment policy. As for the quantitative criteria, the growth in operating income was 2.4% higher than the growth in operating expenses, the efficiency ratio fell from 81% to 79% and earnings per share were 13% higher, which translated into a return on equity of 12% or a premium of 8.3% over the return on ten-year government loans. The qualitative criteria for 2009 focused principally on risk management and accounting organisation and on these criteria the Managing Board outperformed the targets by a substantial margin.

Based on the results measured against the quantitative and qualitative criteria, the chairman of the Managing Board has been awarded short-term variable remuneration for 2009 in accordance with the remuneration system of 48.4% of his fixed salary. The CFO has been awarded short-term variable remuneration for 2009 of 39.9% of his fixed salary and the other members of the Managing Board 36.3% of their fixed salary.

In accordance with the contract with Mr. Kadiks, the percentage for this former Managing Board member for 2009 was 92.6% for the period to the end of August 2009. Mr. Kadiks qualified for higher short-term variable remuneration because his contract made no provision for long-term variable remuneration.

The long-term variable remuneration does not become unconditional for three years. The long-term variable remuneration is calculated on the basis of the average growth in earnings per share over three years. ‚At target‘ performance is defined as average growth in earnings per share of 10% per year over a period of three years. If ‚at target‘ performance is achieved, the chairman of the Managing Board receives 50% of his fixed gross annual salary and the members of the Managing Board receive 40% of their fixed gross annual salary in the form of performance shares and options. Extraordinary income and expenses are not included.

Given the exceptionally poor results in 2008, no long-term variable remuneration would be payable in respect of the periods 2007-2009 and 2008-2010. The Supervisory Board takes the view that, given the extraordinary circumstances that prevailed in 2008, this would give rise to an inequitable situation in which the Managing Board would not qualify for long-term variable remuneration for a number of years. The new remuneration policy for the Managing Board provides a more balanced system of long-term variable remuneration and in particular takes better account of possible (extreme) excursions in the result, both upwards and downwards. The Supervisory Board also intends to apply the new remuneration policy to the current three-year period for the incumbent members of the Managing Board. This will result in an equitable and realistic outcome for the Managing Board over those periods.

Under the agreed pension plan for the Managing Board, which is a defined-contribution (DC) scheme, a fixed contribution of 24.9% was paid into each member’s pension and life-course savings plan. The company also bore the cost of term life insurance and incapacity benefit insurance for members of the Managing Board. The expense allowance scheme for the Managing Board has been abolished.

A change-of-control clause has been agreed with the two new members of the Managing Board, under which they are entitled to one year’s salary in the event of a change of control. This clause will also be included in the contracts with the other members of the Managing Board.

The remuneration report by the Supervisory Board has been posted on the company’s website. The report explains how the remuneration policy has been applied in practice in the past year and provides an overview of the proposed remuneration policy for the coming years.

A revised remuneration policy for the Managing Board for 2010 has been placed on the agenda of the Annual General Meeting of Shareholders on 21 April 2010.

Composition of the Supervisory Board

The Supervisory Board consists of six members. All the members of the Supervisory Board are independent within the meaning of the corporate governance code and none is a former member of the Managing Board. The members of the Supervisory Board receive no profit-related remuneration. None of the members of the Supervisory Board holds KAS BANK shares or options.

The Supervisory Board has formulated a membership profile that defines its size and composition. The membership profile for the Supervisory Board was discussed at the General Meeting of Shareholders in 2004 and 2005 and is posted on the company’s website. A properly constituted Supervisory Board should encompass knowledge of or experience or familiarity with information and communications technology, accounting organisation, national and international banking, securities and derivatives, social policy, national and international business, the workings of institutional investors and financial institutions and the (European) securities industry.

The duties and procedures of the Supervisory Board are defined in by-laws, which are posted on the company’s website.

The members of the Supervisory Board retire by rotation. Messrs. R.A.H. van der Meer and A.H. Lundqvist were due to retire from the Supervisory Board by rotation at the end of the 2009 General Meeting of Shareholders. Both offered themselves for reappointment.

On the nomination of the Supervisory Board, Messrs. Van der Meer and Lundqvist were reappointed as members of the Supervisory Board, both for a term of four years. No other candidates were nominated by the General Meeting of Shareholders.

Mr. C. Griffioen and Ms. H. Donkervoort are due to retire by rotation from the Supervisory Board at the end of the General Meeting of Shareholders on 21 April 2010. Mr. Griffioen is not eligible for reappointment, having completed the maximum term of 12 years. Ms. Donkervoort has not offered herself for reappointment.

Committees formed by the Supervisory Board

The Supervisory Board has formed three committees: the Risk Management Supervision Committee, the Audit Committee and the Appointments and Remuneration Committee. The task of the committees is to prepare for decision-making by the Supervisory Board.

The Risk Management Supervision Committee is responsible for supervising the Managing Board with regard to all banking-related aspects of the company’s internal risk control and monitoring systems, including credit risks, liquidity risks, market risks and operating risks. The Risk Management Supervision Committee met on three occasions in 2009. The main items on the agenda were the status of the risk management programme, ICAAP reporting, business continuity management and credit reporting. In the context of the risk management programme, discussions were held interalia on the policy plans for the various risk management programmes and their implementation.

The Risk Management Supervision Committee consists of three members of the Supervisory Board: Messrs. R.A.H. van der Meer (chairman), D.J.M.G. Baron Van Slingelandt and J.M.G. Frijns.

The Audit Committee is responsible for supervising the Managing Board with regard to all accounting-related aspects of the company’s internal risk control and monitoring systems, focusing in particular on the quality, integrity and selection of the financial information provided by the company, the role and functioning of the Internal Audit department, the relationship with the external auditors, with particular reference to their independence, and the bank’s ICT security. The Audit Committee met four times in 2009. The main items on the agenda were the annual and interim reporting, the loss analyses and the budget for the coming year. The Audit Committee consists of three members of the Supervisory Board: Messrs. C. Griffioen (chairman), R.A.H. van der Meer and A.H. Lundqvist.

The Appointments and Remuneration Committee is responsible for defining the selection criteria and appointment procedures for members of the Supervisory Board and Managing Board and carrying out preliminary work in connection with appointments and reappointments to the Managing Board and Supervisory Board. The committee also submits proposals to the Supervisory Board relating to the remuneration policy and the remuneration of the individual members of the Managing Board. The Appointments and Remuneration Committee held six meetings in 2009, at which the business transacted included the preparation of proposals for the appointment of the new members of the Managing Board and Supervisory Board, the remuneration of the members of the Managing Board, preparations for a new remuneration policy for the Managing Board and the pension plan for the Managing Board members.

The Appointments and Remuneration Committee consists of three members of the Supervisory Board: Messrs. A.H. Lundqvist (chairman) and D.J.M.G. Baron van Slingelandt and Ms. H. Donkervoort.

The minutes of all the meetings of the committees are submitted to the Supervisory Board, on the basis of which the chairman of each committee reports on its deliberations, findings and recommendations.

Amsterdam, 3 March 2010

The Supervisory Board:

D.J.M.G. Baron van Slingelandt, chairman

J.M.G. Frijns, vice-chairman

C. Griffioen

A.H. Lundqvist

R.A.H. van der Meer

H. Donkervoort

Report of the Managing Board

2009 results

The operating profit rose 12% in 2009 to €21.0 million (2008: €18.8 million), mainly driven by a €2.8 million (3%) reduction in operating expenses. Operating income in 2009 remained very close to the 2008 level at €132.0 million (2008: €132.3 million).

The effect of exceptional items on the result in 2009 was €3.6 million positive (2008: €58.7 million negative) and consisted mainly of capital gains on securities which had been subject to impairment in prior years. Including exceptional items, the result in 2009 was €24.6 million positive (2008: €39.9 million negative).

In July 2009, KAS BANK acquired Deutsche Postbank Privat Kapitalanlagegesellschaft mbH, which was fully integrated into KAS Investment Servicing GmbH in the fourth quarte r of 2009. Deutsche Privat Kapitalanlagegesellschaft mbH made a positive contribution to profit in 2009.

On the basis of the operating result, the return on equity in 2009 was 12% (2008: 9%) and the operating efficiency ratio was 79% (2008: 81%).

Capital adequacy

KAS BANK’s focus on a low risk profile is reflected in the quality of the balance sheet and the relatively high BIS ratio, which averaged 21% in 2009 (2008: 15%). As at year-end 2009, the BIS ratio was 24% (2008: 18%) and the Tier 1 ratio was 21% (2008: 15%).

Dividend

The Managing Board will propose to the General Meeting of Shareholders, with the approval of the Supervisory Board, that a final dividend be declared of €0.40 in cash per KAS BANK ordinary share. Including the interim dividend of €0 .33, this will bring the total dividend per ordinary share for 2009 to €0.73 (2008: €0.45 per ordinary share). It is KAS BANK’s policy to fund small acquisitions, such as that of Deutsche Postbank Privat Investment Kapitalanlagegesellschaft mbH, from the profit for the financial year concerned. The dividend of €0.73 per ordinary share has been determined on the basis of a pay-out ratio of 61% of the operating profit, after adjustment for the investment in the intangible assets of the recent acquisition.

Operating income

Operating income in 2009 showed little change at €132.0 million (2008: €132.3 million). Lower commission income was offset by higher interest and other income.

| (in millions of euros) | 2009 | 2008 | change | % |

| Interest | 30.7 | 28.9 | 1.8 | 6% |

| Commission | 75.3 | 89.2 | -13.9 | -16% |

| Result on investments | 24.0 | 13.5 | 10.5 | 78% |

| Other income | 2.0 | 0.7 | 1.3 | |

| Operating income | 132.0 | 132.3 | -0.3 | 0% |

| Exceptional income | 4.9 | -2.7 | 7.6 | |

| Total income | 136.9 | 129.6 | 7.3 | 6% |

Interest income was 6% higher at €30.7 million (2008: €28.9 million), driven by a wider interest spread in the first half of 2009, mainly on government-guaranteed bonds. These were swapped for a 3-month interest rate, to take advantage of the relatively wide credit spreads.

Commission income was 16% lower at €75.3 million (2008: €89.2 million), largely due to the decline in commission income from securities lending in the wake of the financial crisis and the deteriorating market conditions since the fourth quarter of 2008. Excluding securities lending, commission income was only 3% lower. The change in commission income is analysed by source below.

| (in millions of euros) | 2009 | 2008 | change | % |

| Custody and investment management services | 30.1 | 28.7 | 1.4 | 5% |

| Clearing and settlement | 33.8 | 37.6 | -3.8 | -10% |

| Other | 6.3 | 5.7 | 0.6 | 11% |

| Subtotal | 70.2 | 72.0 | -1.8 | -3% |

| Securities lending | 5.1 | 17.2 | -12.1 | -70% |

| Total commission income | 75.3 | 89.2 | -13.9 | -16% |

The acquisition of Deutsche Postbank Privat Kapitalanlagegesellschaft mbH helped to boost income from custody and investment management services. Lower transaction volumes were partly responsible for the decline in commission income from clearing and settlement. The development of new services helped to drive the growth in other commission income.

The result on investments is analysed in the table below.

| (in millions of euros) | 2009 | 2008 | change | % |

| Trading – foreign-exchange transactions | 11.7 | 12.1 | -0.4 | -4% |

| Trading – securities and derivatives | 2.4 | -0.4 | 2.8 | |

| Investments – investment portfolio | 9.9 | 1.8 | 8.1 | |

| Result on investments – normal operations | 24.0 | 13.5 | 10.5 | 77% |

| Result on investments – exceptional | 4.9 | -2.7 | 7.6 | |

| Total result on investments | 28.8 | 10.8 | 18.0 |

The result on investments in normal operations was €10.5 million higher at €24.0 million. The increase can be attributed mainly to gains on the sale of bonds and, to a lesser extent, equities from the investment portfolio. Lower market interest rates in the second half of 2009 exerted some pressure on interest income.

The exceptional result on investments rose €7.6 million to €4.9 million (2008: €2.7 million negative), of which €4.3 million related to gains on bonds which had been subject to impairment the year before. The capital gain on the sale of the shareholding in NYSE/Euronext (€1.5 million) is accounted for as an excepti onal result.

Lastly, there was a €1.1 million negative (2008: €2.7 million negative) effect on the exceptional result from the impairment of a derivative. This charge has been treated as an exceptional item because the corresponding item is recognised in equity under IFRS.

Operating expenses

Operating expenses are analysed in the table below.

| (in millions of euros) | 2009 | 2008 | change | % |

| Staff costs | 67.3 | 70.1 | -2.8 | -4% |

| Premises costs | 3.4 | 3.6 | -0.2 | -7% |

| ICT costs | 14.7 | 16.1 | -1.4 | -9% |

| General overheads | 11.0 | 9.6 | 1.4 | 15% |

| Depreciation/amortisation | 8.1 | 7.9 | 0.2 | 3% |

| Total operating expenses – normal operations | 104.5 | 107.3 | -2.8 | -3% |

| Operating expenses – exceptional | 0.8 | 0.9 | -0.1 | -11% |

| Total operating expenses | 105.3 | 108.2 | -2.9 | -3% |

Reduced usage of external temporary staff and lower pension charges were largely responsible for the lower staff costs in 2009. ICT costs were lower mainly due to the completion of a number of projects for which the majority of the expense was recognised in 2008. The increase in general ove rheads chiefly reflects higher consultancy costs.

The exceptional operating expenses in 2009 relate to the formation of a provision for KAS BANK’s contribution to the DSB deposit guarantee scheme (€0.8 million).

Impairment losses

A net €0.3 million positive (reversal) was recognised in impairment charges in 2009. Impairment losses of €73.4 million, due partly to the financial crisis, were recognised in 2008.

Investment portfolio quality

Both the securities in the available-for-sale portfolio and the investments at fair value through profit or loss are analysed by credit rating (Moody’s Investor Services) in the table below.

| (in millions of euros) | 31-12-2009 | Percentage of portfolio | 31-12-2008 | Percentage of portfolio |

| Aaa-Aa 3 | 1,339 | 93% | 537 | 75% |

| A1-A3 | 37 | 2% | 35 | 5% |

| Baa 1-Baa 3 | 40 | 3% | 10 | 1% |

| P1-P2 | 0 | 0% | 100 | 14% |

| Shares | 28 | 2% | 33 | 5% |

| Total | 1,444 | 100% | 715 | 100% |

The increase of €729 million in the investment portfolio to €1,444 million is largely a product of KAS BANK’s policy of converting part of its cash and cash equivalents into triple-A securities. As at year-end 2009, 93% of the investments had a rating of Aa3 or higher (year -end 2008: 75%).

Risk-weighted value of the assets

KAS BANK’s action to lower its risk profile resulted in an increase in the BIS ratio from an average of 15% in 2008 to an average of 21% in 2009. KAS BANK’s focus on high-quality assets is reflected in the balance sheet in the growth in the available-for-sale portfolio and the investments at fair value through profit or loss and the simultaneous decrease in loans and advances. The relatively large increase in banks and the decrease in loans and advances are mainly the product of different levels of netting of debit and credit balances which, under the accounting rules, are not netted in the balance sheet but are netted in calculating the weighted assets and the capital requirement.

The Tier 1 capital increased to €145 million. The risk-weighted value of the assets, including off-balance-sheet commitments and operational risk, decreased €233 million to €707 million (2008: €940 million). The year-end carrying amount is compared with the risked-weighted value in the table below.

| (in millions of euros) | Carrying Riskweighted amount 2009 | value 2009 | Carrying amount 2008 | Riskweighted value 2008 |

| Banks | 2,707.4 | 83.2 | 1,693.7 | 145.0 |

| Loans and advances | 907.2 | 45.4 | 2,433.9 | 81.5 |

| Reverse repurchase agreements | 584.3 | 0.6 | 732.6 | 0.0 |

| Derivative financial instruments | 92.1 | 74.7 | 386.1 | 140.7 |

| Investments at fair value through profit or loss | 154.6 | – | 32.4 | – |

| Available-for-sale investments | 1,289.3 | 126.1 | 682.4 | 110.7 |

| Property and equipment | 44.1 | 44.1 | 50.7 | 50.7 |

| Other balance sheet items | 550.7 | 59.9 | 1,348.4 | 131.9 |

| 6,329.7 | 434.0 | 7,360.2 | 660.5 | |

| Contingent liabilities | 30.8 | 5.5 | 84.6 | 7.4 |

| Irrevocable facilities | 62.8 | – | 58.0 | – |

| Operating risk | 252.4 | 230.1 | ||

| Securities lending | 14.9 | 41.7 | ||

| Total of the risk-weighted items | 706.8 | 939.7 | ||

| 2009 | BIS 2009 | 2008 | BIS 2008 | |

| Tier 1 | 145.0 | 21% | 141.3 | 15% |

| Tier 2 | 22.3 | 24.4 | ||

| Total BIS | 167.3 | 24% | 165.6 | 18% |

Liquidity

The following maturity calendars show the non-discounted cash flows from KAS BANK’s financial assets (excluding equities) on the basis of the contractual maturity date:

| Maturity calendar as at year-end 2009 | On demand | ≤ 3 months | ≤ 1 year | ≤ years | >5 years | Total |

| Banks, loans and advances and other financial assets | 76% | 20% | 1% | 1% | 2% | 100% |

| Available-for-sale investments | 20% | 4% | 20% | 46% | 10% | 100% |

| Total financial assets | 63% | 17% | 5% | 11% | 4% | 100% |

| Maturity calendar as at year-end 2008 | On demand | ≤ 3 months | ≤ 1 year | ≤ 5 years | > 5 years | Total |

| Banks, loans and advances and other financial assets | 81% | 18% | 0% | 0% | 1% | 100% |

| Available-for-sale investments | 4% | 16% | 24% | 26% | 30% | 100% |

| Total financial assets | 72% | 18% | 3% | 3% | 4% | 100% |

The financial assets remain highly liquid, with 63% available on demand as at year-end 2009 (year-end 2008: 72%). The increase in financial assets with a maturity of between one and five years from 3% to 11% relates mainly to investments in government-guaranteed bonds, on which the interest-rate risk has been mitigated by swapping for three-month Euribor plus a premium. As at year-end 2009, the liquidity surplus by the Financial Supervision Act’s definition was €1.6 billion (2008: €1.5 billion).

Strategy and objectives

KAS BANK aims to be a leader in wholesale securities services in Europe in the field of transaction processing, custody and risk management. The strategy we have adopted to achieve this objective is based on ‚pure play‘, neutrality, transparency and financial stability.

With our clear focus on wholesale securities services, our relationship with our clients is that of a partner. We have designed a business model that precludes any conflict of interest with clients and our activities represent no threat to our clients in their area of specialisation. This combination of ‚pure play‘, financial solidity and client focus constitutes the critical added value offered by KAS BANK.

The essential components of our strategy, our approach to risk management and our financial targets are considered in greater depth below.

Target groups

KAS BANK has operated on the wholesale market, serving only institutional investors and financial institutions, since 2007. Our clients can be divided into six groups: pension funds (including their clients such as savers and administrative organisations), insurance companies, investment funds, asset managers, banks and brokers. Within these six groups, there are a number of specific categories, such as lower-tier government, charitable institutions and housing associations. We do not provide services for retail clients directly.

Products and services

KAS BANK offers its clients a wide range of securities-related services and products. The services are divided into transaction servicing (supporting the settlement of securities transactions in the broadest sense) and asset servicing (custody and management of securities, including administration, valuation, monitoring and risk management). KAS BANK is unique in that it specialises exclusively in securities support services and operates exclusively on the instructions of its clients.

KAS BANK has built a strong position in the European clearing and settlement market. By the end of 2009, there were ten alternative stock exchanges connected to our single technical platform, as well as eighteen traditional stock exchanges. This gives our clients access to the entire infrastructure in Europe on one platform. The platform processes both securities and derivatives, facilitates over-the-counter (OTC) transactions (unquoted securities) and monitors the clients‘ risks as well as the bank’s. Its centralised structure makes it easy to expand, in terms of scope (new stock exchanges, Central Counter Parties and the European Central Bank’s Target2Securities system) and product content (including direct market access and back-office administration).

On the institutional market, both the focus and the services are shifting increasingly from legal ownership (custody) to economic ownership (investment administration and risk management). KAS BANK offers a complete package of services in this area, which will continue to grow in complexity and depth in the coming years. Benefiting from the good standing of the Netherlands in the field of pension management and the bank’s own reputation and experience, KAS BANK can steadily extend its position in Germany, the United Kingdom and other European countries.

Regions

KAS BANK operates mainly in Europe. Although the bank’s growth ambitions are concentrated at present mainly on the West European markets, growth in Central Europe is a longer-term objective. Our global network of close to a hundred correspondent banks ensures high-quality services outside Europe.

The primary function of our offices in London, Wiesbaden and Amsterdam is to support institutional investors and financial institutions. Apart from their commercial activities, the offices outside the Netherlands perform only the necessary minimum of administrative and risk-management tasks; central management and processing are handled in Amsterdam. KAS BANK is therefore a centrally organised bank, from the perspective of both the client and the regulator.

Environment

KAS BANK’s analysis of its environment encompasses financial/economic, regulation/supervision, technology, social/cultural and market/client components.

Financial/economic

KAS BANK is at the centre of the financial industry. KAS BANK provides services to financial institutions and institutional investors, is part of the infrastructure and is thus sensitive to developments on the financial markets. This sensitivity affects, on the one hand, the volume component interalia in securities transactions and securities lending and, on the other, in the case of interest-rate-dependent operations, the evolution of the interest-rate curve.

Regulation/supervision

The credit crisis highlighted how interdependent the financial sector has become, both within and across national borders. In some instances, this interdependence triggered undesirable chain reactions, exposing the business models of several banks as incapable of withstanding the pressures of the market as a whole. Thanks to effective action by central banks and various governments, a global systemic crisis was averted. The price that has been paid is the distortion of the level competitive playing field by the various liquidity measures, direct capital support and other factors.

In the wake of the credit crisis, numerous measures have been taken to optimise risk management within the financial sector and improve supervision. This action has prompted financial institutions to reconsider their strategy and review which activities do and do not form part of their core competences. The question that now arises is whether, given their high degree of specialisation and complexity, wholesale securities services can still be counted among the core competences of diversified financial institutions. The first indications are that the credit crisis will initiate a new wave of outsourcing of securities functionalities.

Meanwhile, the more intensive risk management practised by client organisations and external supervisors is creating a growing demand for information and supplementary reporting. In the institutional market, there has been evidence for some time of a trend towards consolidation among pension funds, driven by the need to have a minimum size to meet the increasing demands placed on pension institutions. At the same time, the number of pension administrators, among which insurance companies must also be counted, is growing. These pension administrators take over the duties and obligations of the small funds and integrate them into their own operations. Similar processes are also in evidence in Germany and the United Kingdom.

Technology

High-grade technology is essential to ensure the best possible quality of service in the environment in which KAS BANK operates. Our ICT processes and procedures are continuously updated and optimised to keep pace with the rapid developments in the securities industry. We also invest continuously in high-quality hardware and software and in the expertise and skills of our ICT staff. An important element here is the internal In Control Statement for KAS BANK’s operating ICT processes, as an extension of SAS 70. A SAS 70 Type II report was published in respect of the second half of 2009.

Social/cultural

As part of the financial sector, KAS BANK was also affected in 2009 by the loss of confidence in the banking sector on the part of politicians and public. We are pleased to report that our clients‘ confidence in KAS BANK was unshaken and the bank’s position and operations did not become the subject of wider public debate. On the contrary, a broad sector of the market expressed a growing positive interest in financial institutions that combined clear client focus and a high degree of specialisation, because they were perceived as capable of accurately assessing and subsequently managing their risk profile.

KAS BANK has not had recourse to government support during the credit crisis or thereafter and, given the bank’s financial position, it has not been necessary to call on the shareholders for additional capital. Notwithstanding the comparatively exceptional position that KAS BANK occupies, both within the financial sector and within our international theatre of operations, we do not undervalue the importance of the various measures taken by national governments.

Market/client

The European securities market has historically been a fragmented market. The purpose of the Markets in Financial Instruments Directive (MiFID), which came into effect in Europe in 2007, was to improve the transparency and effectiveness of the European markets. One of the consequences of MiFID has been that the existing European stock exchanges have started to compete with one another and with the new alternative stock exchanges, the Multilateral Trading Facilities (MTFs). The same is about to happen with the clearing institutions. Lastly there is the Target2Securities (T2S) initiative led by the European Central Bank, which aims to further harmonise the settlement and custody of securities in Europe.

A direct consequence of all these initiatives will be that European securities settlement will become increasingly complex. KAS BANK fully supports the ultimate objective – a competitive internal European securities market – and, until that becomes a reality, will continue to offer a European service that is complementary to those initiatives and developments.

To compete more effectively, KAS BANK will further define its positioning as a specialist provider of tailor-made services. More support capacity will be provided for each client relationship, directly responding to the growing demand for intensive operational assistance on the part of KAS BANK’s clients, both financial institutions and institutional clients.

A noteworthy development in this context, prompted to some extent by recent events, is the changing profile of clients‘ preferred type of custody organisation. They increasingly favour specialists and compact organisations whose balance sheets (and hence the counterparty risk they present) can be readily interpreted. As a specialist in settlement services with a strong liquidity position and a low risk profile, KAS BANK is attractive to (larger) players which have made ‚a specialist with a sound reputation, close to home‘ one of their selection criteria. They increasingly perceive KAS BANK as a logical discussion partner.

Due to the influence of the regulators, factors which are becoming increasingly important in the selection of custody and administration services – apart from high-quality service and a competitive price – include the quality of the provider’s monitoring framework, its knowledge of local infrastructures and tax law and the human factor in the advice and support provided for the client. These are areas where specialists like KAS BANK can profile themselves more strongly. Production and support need to be moved back closer to the client. KAS BANK is responding actively to these changing client preferences as a means of raising our competitiveness.

SWOT analysis for KAS BANK

| Strengths | Weaknesses |

| ‚Pure play‘ strategy | Limited geographical scale |

| Strong position in Dutch market | Relatively low growth |

| Strong capital adequacy and liquidity position | Instability of financial markets |

| Opportunities | Threats |

| Outsourcing | Competition from CSDs |

| Growth outside the Netherlands | Sustained pressure on prices |

| Investment funds | Slow recovery in securities lending market |

Trends

With the passage of time, custodians have increasingly assumed the information management function. In an ever more strictly regulated environment such as the securities industry, this function is bound to grow in importance. In broadening the scope of its services, KAS BANK is expressly anticipating the growing effect of regulation. For example, we are responding actively to the trend on the part of financial institutions to require their transactions to pass through central counterparties. We established a direct link to the Scandinavian infrastructure in 2009 when a central clearing mechanism was introduced there. The reserves requirements that have been announced for unquoted derivatives under Basel II will further support and accelerate the move towards central settlement of these and other asset classes, creating more opportunities for us to expand our services in the near future.

Market self-regulation also offers good growth potential for KAS BANK. In response to the changes in the stock exchange landscape wrought by MiFID, we have positioned ourselves more explicitly as post-trade experts in broker solutions, offering direct access to multiple stock exchanges and MTFs. Our services are integrated into the software (KAS BANK-inside) that we provide for trading clients. We foresee ongoing development in this area, with high-frequency traders growing in importance and the traditional wide spreads continuing to narrow. We also expect further fragmentation of trading liquidity in 2010, although the pace of change will be slow.

The increasing complexity of the investment process and the growing need to be ‚in control‘ are reflected in continuing sales of our risk management products, with clients expressing strong interest in our Institutional Risk Management (IRM) monitor and our Peek Through service (which gives access to the underlying values of investment funds). Our proposition is strengthened by our independent position (we do not offer asset management). Implementation and monitoring by KAS BANK are becoming ever more important as a source of independent validation of the effective discharge of management responsibilities.

KAS BANK has already taken over the investment guideline monitoring function required by the regulator on behalf of many pension fund boards and pension departments. This function will continue to grow in importance for pension funds operating under the increasing regulatory pressure. We envisage rising demand for our risk management and reporting services within the institutional investor segment. The shift towards more extensive outsourcing (in response to pressure exerted by regulators) also necessitates further professionalisation of the monitoring framework. KAS BANK will position itself even more explicitly as a specialist in monitoring the investment and risk guidelines of institutional investors, acting on behalf of the board. In this function, we offer audits of the investment process, the results and the quality of prices, giving the board the overview it needs of the operating risks inherent in the investment policy implemented under its responsibility.

Our services are consistent with the recommendations made by the Investment Policy and Risk Management Committee in its January 2010 report entitled ‚Pensioen: Onzekere zekerheid‘ (Pensions: Uncertain security), in which it advises pension fund boards to take a more professional approach to structural improvement in their risk management and to implementation of investment policy.

Other trends that are relevant to KAS BANK include the growing popularity of unquoted investments and exchange-traded funds as active investment instruments. In terms of settlement, both instruments still rely heavily on non-automated processes (involving higher operating risks). The automated services which KAS BANK is developing to serve this need represent an advance in both quality and efficiency for our clients and prospects.

Tactical approach

The way in which KAS BANK serves the market’s needs is discussed below under the headings’pure play‘, operational excellence and acquisitions.

‚Pure play‘

For a specialist like KAS BANK, ‚pure play‘ means:

| • no active asset management | |

| • Focus on wholesale securities services | • no active trading for own account |

| • no conflict of interest with clients | |

| • no internal Chinese walls | |

| • neutral | |

| • Focus on core values | • transparent |

| • low risk, stability | |

| • Client-driven | • more and better integration with clients by focusing on specialism |

Operational excellence

We aim constantly for operational excellence in our day-to-day activities. We adopt a ‚zero tolerance‘ processing policy, recognising the need for effective support for our clients‘ confidential and vulnerable processes that KAS BANK systems provide.

Our striving for operational excellence involves making constant make-or-buy choices. We purchase both IT platforms and specific services and products from third parties. This also enables us to offer clients specialised services of high quality.

Acquisitions

The credit crisis underlines once again the importance of specialisation and good risk management. With new regulations and the greater client emancipation making wholesale securities services within Europe ever more complex, generic financial institutions are increasingly looking to outsource their activities in this area. Such transactions are rather complicated and are often not given the highest priority by the vendor, making it difficult to predict how fast the industry will Ôunravel‘. What is clear is that, as a specialist and’pure player‘, KAS BANK is well placed to meet this demand. Like our first acquisition in Germany in 2008, the acquisition of part of Deutsche Postbank’s investment management business in mid-2009 is an excellent illustration of this.

In both cases, our absolute independence and neutrality were significant additional factors in the vendor’s decision to outsource to KAS BANK. Once again, KAS BANK’s ‚pure play‘ strategy proved its worth, because the absence of any conflict of business interest meant that the relationship with the vendor could last for many more years.

In 2010, given the uncertainties now facing the financial industry, KAS BANK will concentrate on further small acquisitions in Germany in the first instance, then in the Netherlands and the United Kingdom. Acquisitions in other parts of Western and Northern Europe are not, however, being ruled out in advance. The emphasis will be mainly on institutional portfolios.

Any acquisitions will be financed out of the bank’s own funds, on condition that they contribute to earnings per share.

Financial targets

KAS BANK publishes its longer-term financial targets each year. These targets represent averages over a number of years. It may happen, therefore, that the targets are not achieved in any one year, for example due to unrest on the financial markets or an acquisition.

| Ratio | Target | 2009 * | 2008 * |

| Growth in operating income versus growth in operating expenses * | >-3% | 2.4% | -6.3% |

| Efficiency ratio | 70-77% | 79% | 81% |

| Return on equity | 5-8 points above 10-year interest rate | 12% ** | 9% |

| Growth in earnings per share | >8% | 13% | -20% |

| Dividend pay-out ratio | 60-80% | 61% *** | 35% |

| Average BIS ratio | Basel II>-12.5% | 21% | 15% |

* Excluding exceptional items

** 10-year interest rate 2009: 3.7% (2008: 4.2%)

*** Based on operating profit less the amount of the investment in intangible assets relating to the recent acquisition

The financial targets confirm KAS BANK’s low risk appetite. A relatively high BIS ratio, a realistic dividend for the shareholders and a growth target that is related to the trend in expenses mean that KAS BANK is able to prevent undesirable incentives distorting the relationship between growth, risk and return.

Risk control and monitoring systems

That KAS BANK has a low risk appetite was clearly reaffirmed by the Managing Board and endorsed by the Supervisory Board in 2009. The management framework for monitoring and enforcing the low risk profile comprises three elements:

| • |

Prudent management of the mix of wholesale activities. Current and new activities are checked to ensure that they have a low intrinsic risk profile. The bank’s key performance indicators (KPIs) and remuneration policy are consistent with its low risk profile and are monitored to ensure that this is maintained. The bank’s reputation and compliance with its low risk profile are monitored by the Managing Board and the compliance function. |

| • |

Systematic risk management. The bank’s low risk appetite is translated into all identified risk categories. Firm targets are set and enforced within the applicable management frameworks. These include operating a ‚zero tolerance‘ policy on operating risks, lending only against adequate collateral of high quality and maintaining ample liquidity and capital reserves. |

| • |

Capital management. Even a low risk profile involves some risk, albeit limited, because risk is inherent in business. The risks are absorbed by the bank’s resilience, in which its profit capacity and capital buffers are significant elements. Internal capital requirements are set for the bank’s activities, in addition to those imposed by the regulator. Capital planning is part of the annual budget-setting process. |

The risk management framework comprises three lines of defence:

| • |

the first is line management, which is responsible for identifying and controlling the risks in its processes and products; |

| • |

the second is formed by the Risk Management, Human Resources, Administrative & Corporate Development, Financial Control & Reporting, Compliance and Legal departments, which are responsible at bank level for analysis, policy preparation and coordination of the management of the risks to which the bank is exposed; |

| • |

the third is the Internal Audit department, which performs an independent checking and auditing function. |

Policy on the various types of risk is determined by the bank’s Asset & Liability Committee and Risk Management Committee. At the Supervisory Board level, the Audit Committee and Risk Management Supervision Committee oversee the Managing Board’s monitoring of compliance with KAS BANK’s risk management policy and procedures.

A number of significant risks can be identified which are inherent in the bank’s strategy, profile and operations:

| • |

Given KAS BANK’s strategic focus, it is dependent on the financial sector. The credit crisis has not only affected the regular services: it may also influence liquidity, counterparty risk and investment of assets. |

| • |

Although KAS BANK is diversifying its sources of income, its revenues are sensitive to transaction volumes in our clients‘ securities trading activities and to stock market prices. Declining market activity and lower prices mean lower income. |

| • |

It was possible in previous years to make expenses variable to some extent by using external specialists and forming partnerships, but the need for adequate numbers of specialist staff and the ongoing investments in IT mean that fixed costs are relatively high. |

| • |

KAS BANK is in competition with major international banks, which in some cases can place it at a disadvantage in terms of economies of scale and name recognition. |

| • |

Despite the loyal client base in the bank’s home market, the reforms in the European capital markets and the growing competition are putting pressure on margins. |

| • |

Reforms being undertaken by and consolidation among our clients, including pension funds, brokers and institutional investors, may have repercussions for KAS BANK. |

| • |

We rely for the correct settlement of our clients‘ transactions and for the quality of our services in general on the proper functioning of our automated systems and of communication with the infrastructure in the context of our European platform. Because there is a large degree of interdependence between our systems and processes, our ability to respond swiftly to external developments is critical. |

| • |

Given the bank’s specialist character, its expertise and the organisation and embodiment of that expertise in procedures, operating instructions and systems are vitally important. |

| • |

For the settlement of client’s securities transactions and payments, the bank holds collateral with (central) banks and clearing and settlement systems, which requires that our balance sheet is sufficiently liquid. The turbulence on the financial markets in recent years and the almost complete drying up of liquidity on the interbank market have made liquidity contingency planning a high priority. |

| • |

Because most of the bank’s credit risk is hedged by collateral, high-quality and diversified collateral management is of primary importance, especially in times of great volatility. |

| • |

The bank is sensitive to developments in the external infrastructure and regulations and the (political) environment in the areas in which KAS BANK operates. State support for banks can distort competitive relationships and create an unlevel playing field. |

| • |

Securities lending income depends on the willingness of pension funds in particular to lend their securities. |

| • |

KAS BANK’s own position in securities is sensitive to price movements due to changing market, interest rate and credit conditions. |

| • |

• The interest result is sensitive to changes in the shape and level of the interest-rate curve. |

Given the dynamics of the relationship between the bank’s services and the environment in which it operates, the internal risk control and monitoring systems are the subject of continuous development. Qualitative and quantitative information on KAS BANK’s exposure to credit risk, market risk, liquidity risk, operating risk and compliance risk can be found in the ‚Risk management‘ section, which also discusses the purposes of and the principles and procedures used in measuring and controlling these risks.

Financial reporting risks

KAS BANK reports in accordance with International Financial Reporting Standards (IFRS), as adopted within the European Union. Continuous improvement of financial and risk-management information is kept under constant review by the bank.

The structure and functioning of the internal risk control and monitoring systems are regularly evaluated in the light of the bank’s objectives and risk profile, assessed by internal and external supervisors and discussed with the relevant committees formed by the Supervisory Board.

In the light of the foregoing, it can be confirmed with reasonable confidence that the internal risk control and monitoring systems relating to reporting have functioned satisfactorily and that the financial reporting therefore contains no material misstatements. It should be understood that, given their inherent limitations, the internal risk control and monitoring systems cannot:

| • |

provide complete assurance concerning the achievement of strategy, objectives or chosen risk profile; |

| • |

prevent all material inaccuracies or instances of loss, fraud or non-compliance with legislation or regulations. |

Developments